Estimated reading time 14 minutes, 3 seconds.

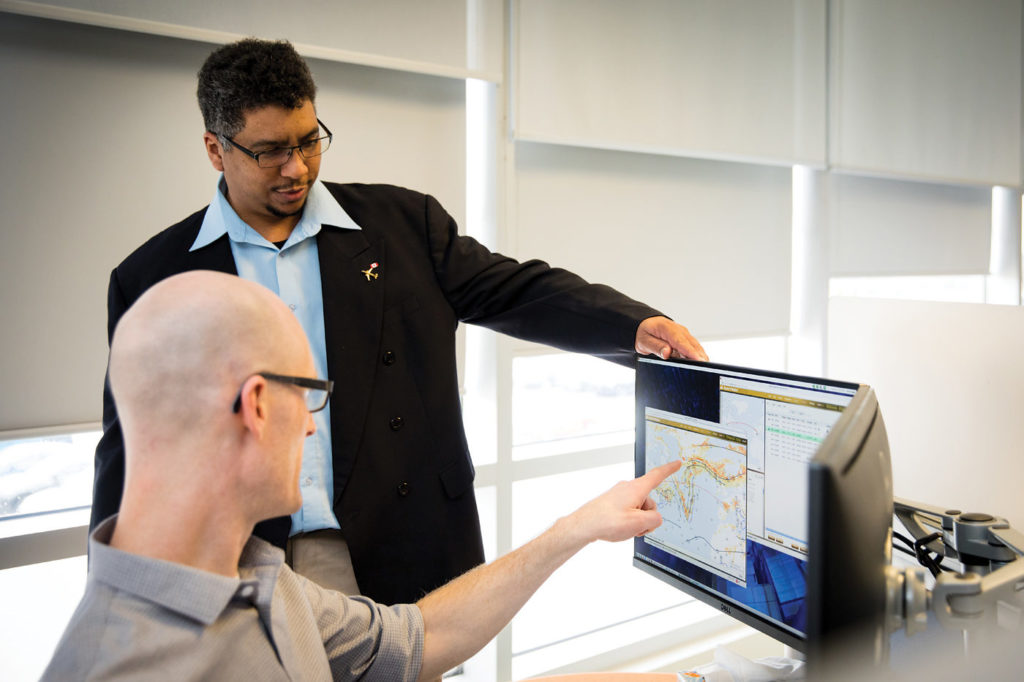

It’s fitting that Navblue has a facility in Waterloo’s cutting edge Accelerator building, because the company has certainly been on the fast track since last July.

That’s when Airbus Group formally launched Navblue as its new flight operations and air traffic management subsidiary. But while the name is new, there’s no doubt it is backed by a wealth of experience. An amalgamation of four separate entities, readers may be surprised to learn that the software component of Airbus’ new venture had its genesis in Canada.

Back in 1987, husband and wife team Ray and Dorothy English–he an airline pilot and she a self-taught computer programmer–founded Navtech in Waterloo, Ont. From ideas that first took shape over their kitchen table, the company went on to develop the first flight planning software for a personal computer (PC).

“In the 1980s, there weren’t a lot of options,” recalled Shawn Mechelke, Navblue’s vice-president of N-Software Services and a 25-year airline industry veteran. “There were no networks at that time; it was standalone basic computers with no connectivity. You would buy a solution and install it on the machines at your office.”

Mechelke was working at American Trans Air (ATA) Airlines when it became the first to buy Navtech’s flight planning software.

He said digital progress hit the airline industry in waves. First, so-called “dumb” terminals displayed information. Then, in-house networks were developed, enabling the use of a server connected to PCs. The dial-up modem was next, allowing airlines to access some digital data. But it was the World Wide Web that really launched airline operations management into the digital age.

“Once the Internet started, that’s where everything went from in-house systems to where we are today and where we’re going tomorrow with software as a service,” Mechelke told Skies. “Putting the server in a big data centre facility . . . That’s where the pivot point happened. All you need is a computer with the Internet and you can get everything you need.”

From its first successes, Navtech’s growth was steady and sure. Over time there were strategic partnerships and small acquisitions that continued to build on the company’s capabilities.

In 1993, Navtech bought Compuflight, an addition that introduced aircraft performance data to the equation. In 1998, the weather service division of Global Weather Dynamics, a small U.S. company, was added to the mix. The acquisition of Airware Solutions in 2001 introduced crew planning capabilities, which allowed Navtech to expand its products to facilitate preferential crew bidding. In 2005, the company purchased European Aeronautical Group and entered the charting business. Finally, a decade later, Navtech absorbed a small U.K. company called DW International, enabling satellite navigation data to be incorporated into its flight planning software.

One of Navtech’s longest-standing employees is Mike Yeo, now Navblue’s chief technology officer. He started with Navtech as a computer science co-op student in 1998 and worked his way through various progressive positions to the executive suite. In the transient world of software development, Yeo is well aware that it’s unusual to spend your whole career in one place.

“As it’s grown, I appreciate that this company has given me great opportunity to explore new roles and build new technologies,” he said. “From day one, I was doing important things that were providing important solutions to industry.”

Yeo recalled that in the early days, Navtech’s 30 or so staff members wore many hats and the company brought in about $4 million in revenue.

“It’s been a great journey to see it grow,” he said. “Just prior to the acquisition, we had some 300 people with offices all over the world, $50 million in revenue and served more than 400 airlines.”

Strategic buy

Navtech’s success attracted the attention of Toulouse, France-based Airbus, which was reportedly looking to expand its reach into the aviation software and services industry.

As Mechelke put it, “Airbus, as a manufacturer of hardware–airplanes–they make a one-time sale. But with software as a service, it’s a service and customers expect innovation and enhancements to the service all the time. Navblue consistently innovates, listens to its customers, and provides software solutions to support airlines all over the world.”

Over the Christmas 2015 holiday period, Navtech announced it had been acquired by Airbus for an undisclosed amount. The transaction was approved by regulators in March 2016, and Navblue was introduced to the world during the Farnborough Air Show that summer.

“We are a strategic buy for Airbus,” noted Mechelke. “So now we’re in a long-term strategic position. We have to stay modern and keep investing in our product; Airbus has brought investment to the table. They also bring all their innovation, research and development. With their support, we’ll end up building more innovative software, services and capabilities than ever before.”

Navblue originally united three separate entities–the former Navtech; Airbus ProSky air traffic management solutions; and Airbus Flight Operations Services, which included its runway overrun protection system (ROPS). A fourth division, Airbus eSolutions, was added to the mix which incorporated FlySmart (an electronic flight bag product), aircraft performance tools, a documentation suite and safety/analytics tools.

With about 380 employees in total, the new company also has three main offices: Waterloo (computer software); Hersham, U.K. (charting and data); and Toulouse, France (Airbus software services division).

Now that almost a year has gone by since the creation of Navblue, the pace of product integration and development is quickening.

“We’ve seen big growth in Waterloo,” confirmed Yeo. “In most product lines we’re a 10 per cent market player. Airbus wants to see this grow; they want to invest. Over the next few years, they want to see us become a major player in the market. So we’re experiencing big investment and scaling up considerably.”

When Skies visited Navblue in Waterloo, the company was reorganizing its cubicle system to accommodate 40 to 50 new hires in all areas of the company.

“Every aspect of the company has to grow. At the same time as the big investment from Airbus, our products are maturing in their own right,” said Yeo.

Mechelke outlined the aggressive growth plan. “In the next five years, they’re expecting us to double in size. We’ve never done it that fast in the history of the company, but it will be achieved in three ways. Number one is organic growth; two, through partnerships; and three is by acquisition.”

Product suite

Navblue offers aircraft operators a range of comprehensive services focused on three main areas: software, data and consulting.

Its list of 20 Canadian customers reads like a who’s who of the country’s biggest operators.

For instance, Air Canada uses Navblue’s N-Crew Planning preferential bidding system software for its flight attendant scheduling.

“Most airlines in North America are unionized so they run on a seniority basis,” explained Mechelke. “This system uses heuristic algorithms that allow you to put your preferences in based on seniority. The system tries to match everyone with the best schedule possible based on personal preferences. This creates 30-day-out schedules, plus a pairing optimizer that develops schedules with crews, and builds an airline’s master schedule.”

Mechelke noted this kind of solution must be agreed upon by management and the union, if applicable, and is usually written into the labour agreement.

Jazz Aviation uses the preferential bidding system for its flight attendants and Mechelke said Navblue also provides the operator with a custom built load planning program.

Air Georgian employs the Navblue flight planning system as well as charts from the company’s U.K. office, while Canadian North uses navigation data provided by the company to power its flight planning systems. First Air, Nolinor Aviation, Sunwing Airlines, Cargojet and Cougar Helicopters are other examples of Navblue’s Canadian customer base.

All in all, Navblue provides services to more than 500 operators worldwide, including industry giants like Cathay Pacific and Delta Air Lines. A 24-hour support desk provides technical assistance to clients. The company’s global sales team includes directors in the Americas, EMEA (Europe, Middle East, Africa), Asia-Pacific, and Mainland China.

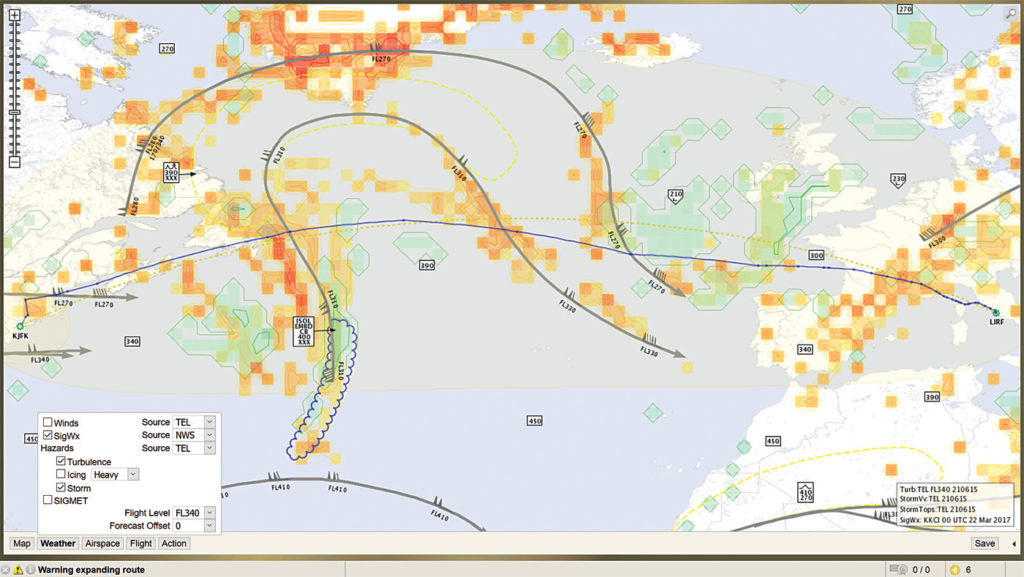

“Flight planning is software as a service. You can install it at your operation or get it from us over the Internet,” said Mechelke. “Usually it’s a monthly fee; a fee per aircraft per month. The same with the preferential bidding system; charges are based on the number of crew members. On the navigation side, data is based on the number of tails you have, and it’s a service that comes out on 28-day cycles. Updates are done by regions and you pay per month.”

In addition, Navblue offers bespoke airspace consulting from Toulouse. Specialists work with air navigation service providers, like Nav Canada, to model airspace and figure out ways to make it more efficient. Sometimes, an airline will hire them to design a high precision approach or similar procedure to give them an edge over the competition.

Challenges and opportunities

Although some may consider the former Navtech to be just another small fish swallowed by the Airbus whale, Yeo said creativity and flexibility has not been lost.

“The message from Airbus is to keep nimble and agile,” he said. “What we’re working toward is creating our own customer-centric hybrid division. I think they [Airbus] are trying to be very pragmatic about it; they want the business case for the company to rest within itself. The company they bought had been consistently profitable for many years and so had the divisions they lumped in.”

From a technology standpoint, Yeo admitted there have been challenges integrating a small, fluid company like Navtech into the massive system that is Airbus.

“The biggest challenge is that Airbus is a much larger company and they have to manage risk to a far greater capacity than a small private company–cyber security, physical security, intellectual property theft–all of those things make a large company a prime target. One of the first big things for us was a leap forward in terms of cyber security.”

Mechelke also pointed out that the former Navtech was “aircraft agnostic” and worked with every OEM. “Now, with the Airbus piece, we will need to maintain the ability to work with every OEM out there. That will be a challenge, because Airbus software was built for Airbus aircraft, of course.”

Yeo said he believes that particular challenge is what underpins the creation of Navblue.

“We could have easily been called Airbus Flight Ops but [Airbus] chose to create a whole separate entity,” he said. “We have always had good relationships with OEMs; throughout the final stages of the acquisition we continued talking to other OEMs to reassure them we wanted to continue working with them. I think we can all benefit from competition and sharing our experiences. This is where Navblue comes in because we can take over that middle ground. We can provide that ‘unified solution’ for mixed-fleet carriers.”

There are many opportunities presented by the Airbus acquisition as well.

Mechelke said the data from Airbus Defence and Space’s high precision satellite network is the stepping stone to “next generation charting” and implementation in electronic flight bags and avionics.

“This technology will revolutionize charting into data-driven charting,” he said. “Instead of having a static display, we have a computer that can build a chart real-time for you based on what you select. The airport moving map database is available today. With data-driven charting, you can customize your charting display. That’s just one to two years out.”

Another key area of focus for Navblue is predictive analytics. That’s the process of collecting and capturing all kinds of data from airframes, engines, the atmosphere and satellite tracking, just to name a few sources, and then using it to predict the future.

“That is one of the very large investments Airbus is making,” confirmed Mechelke. “Today airlines make decisions based on industry knowledge–the ability for us to know things because we work in it every single day and we learn it. We will see a lot of benefit from predictive analytics in the future.”

Yeo added that electronic flight bag (EFB) refinement is another priority. “One of the goals is to create a more integrated EFB experience; a platform that supports the pilot workflow better and facilitates situational awareness and decision-making.”

He said it’s exciting to see the company looking ahead to long-term innovation.

“Having been here for almost 20 years, seeing the company looking at that horizon and making those investments is very exciting. It’s the next level,” said Yeo. “Before, innovation was about new product features. Now, it’s about taking the latest leading edge technologies and creating completely new spaces that didn’t exist before. For a technical team, that’s very exciting!”

The software world moves fast; much faster than the traditional world of aircraft engineering at Airbus. As Navblue challenges the industry’s flight planning heavyweights for a greater market share, the new company will most certainly draw on a wealth of experience from all its divisions. Agility and responsiveness will be a must.

Luckily, those qualities have already been written into Navblue’s DNA.

Lisa Gordon is editor-in-chief of Skies magazine. Prior to joining MHM Publishing in 2011, Lisa worked in association publishing for more than a decade, overseeing the production of customcrafted trade magazines. Lisa is a graduate of the Ryerson University Journalism program.