Estimated reading time 6 minutes, 4 seconds.

JETNET iQ provided its business jet delivery forecast for the next 10 years, as well as results from its latest COVID-focused owner-operator survey during the NBAA’s 2020 Virtual Business Aviation Exhibition and Conference (VBACE). In a press conference on Dec. 2, Rollie Vincent, creator and director of JETNET iQ, said the company is predicting a 29 per cent drop in deliveries for 2020, and forecasts 6,362 bizjet deliveries through 2029 — a $204.4 billion value.

“Some people are saying that seems like a long, slow recovery,” said Vincent. “Well, in fact, we’ve been through this before . . . when OEMs and supply chains slow down, to ramp back up is a challenge. You’ve got to get not just your immediate and large suppliers, you’ve got to get the whole supply chain back up.”

These results are based on the global market, but with a large focus on the U.S., which represents 60 per cent of the worldwide business aircraft fleet in terms of where the aircraft are based.

Vincent said the fixed-wing turbine community in North America is “more optimistic about recovery and utilization” compared to other areas of the world. Just under 40 per cent of these operators in North America said they “strongly agree” their business aircraft usage (flight hours and cycles) will return to pre-COVID levels within the next 12 months, and another 33.7 per cent “somewhat agree.” This data is based on JETNET’s Q3 2020 owner-operator survey.

“JETNET iQ has been doing owner-operator surveys for the last 10 years, and we now have over 20,000 respondents . . . from 135 countries — all of whom own or operate a business aircraft fixed-wing turbine worldwide,” said Vincent. “We always try to gather 500 responses from at least 50 countries to give us good statistical clarity, but also low sampling error.”

In terms of market sentiment or optimism of business aircraft owners/operators worldwide, which JETNET scores between -100 and +100, the company recorded its lowest ever sentiment in Q2 2020, which corresponds with the onset of the pandemic. “We were at +55 and we dropped to -43,” he said. The responses did rebound in Q3, and rose to +18.4 in early Q4, prior to announcements about the high efficacy of the Pfizer vaccine. After that vaccine announcement, the market sentiment rose to +28.1.

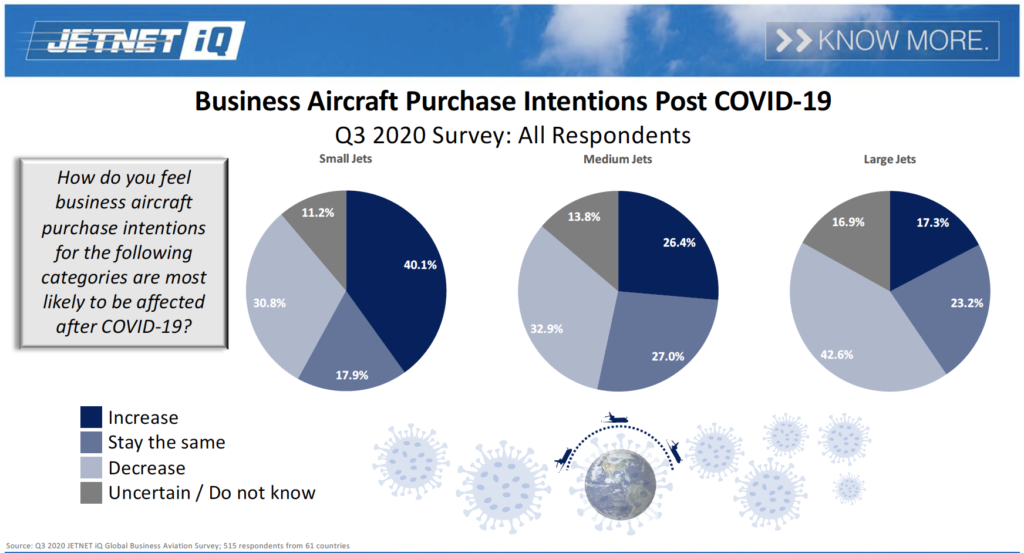

Results from the company’s same Q3 2020 survey show North American buyers are particularly interested in the small jet category of aircraft, which includes everything up to a part 23 light jet like the PC-24. Forty per cent of all respondents said their purchase intentions for small jets would increase after COVID-19. Conversely, 42.6 per cent of all respondents said their purchase intentions for large jets would decrease after COVID-19.

“The owner-operator community is telling us that the small jet business is kind of the place to be for the next little while,” said Vincent. “And it seems the community is telling us that as we move up into the higher categories of aircraft, there’s going to be more of an impact on sales. This could just be reflecting the pandemic, quarantining, and restrictions on international travel, which really impact more of the big airplanes. . . . So we’ll continue to ask this question, and we’ll get more detail.”

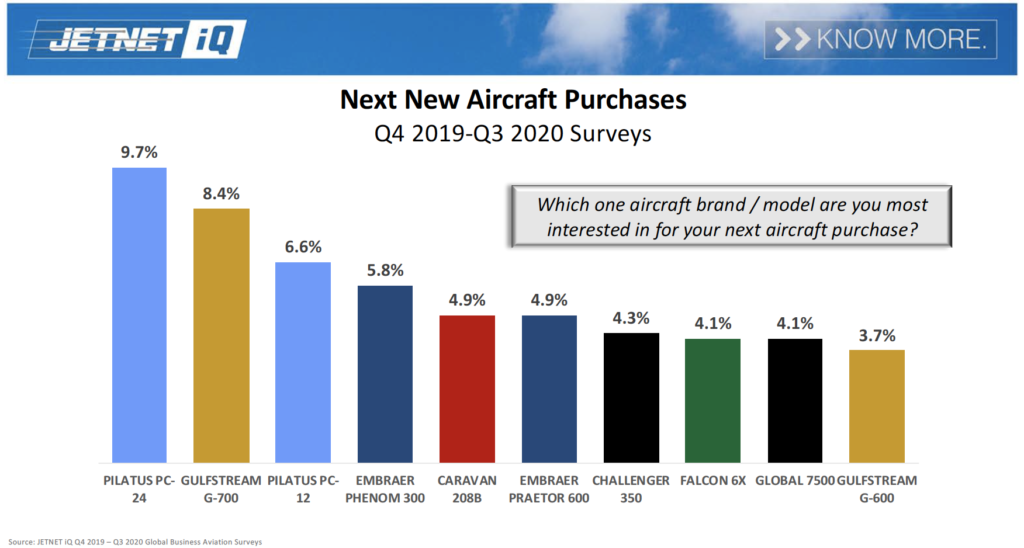

Over the last four quarters (Q4 2019 to Q3 2020), 2,000 survey respondents indicated the business aircraft type they are most interested in purchasing next, with the Pilatus PC-24, Gulfstream G-700, and Pilatus PC-12 taking the top three spots, respectively. Other types that ranked highly include the Embraer Phenom 300 and Praetor 600, Cessna Caravan 208B, and Bombardier Challenger 350.

“This is over 2,000 respondents, and if you think of it, there’s only just over 20,000 companies out there that fly business aircraft in the world,” said Vincent. “So we’ve got around 10 per cent sample size here. This is a very clear signal as to the sorts of airplanes that are of interest around the community.”

Vincent pointed out that some of the types/manufacturers that at one point were at the lower end of the category are now those that are seemingly in demand when it comes to new aircraft.

Regarding a new market segment, specifically the supersonic business jet, Vincent said while COVID-19 has deferred JETNET’s forecast for initial deliveries of an aircraft, “the supersonic business jet is coming to our industry. There’s almost an insatiable demand and interest in this class, like we’ve not seen before. We think it’s coming for sure in the 10-year period, but it’s very much towards the latter part of that forecast.”

JETNET expects there to be three supersonic jet models developed by three different manufacturers that will be successful, “but that’s going to take some time,” said Vincent.

“Is there demand?” he continued. “We do a lot of product testing for the OEMs and engine companies, [and] we’ve never seen more interest and excitement around an airplane as we have for last 15 years on a supersonic airplane.”