Estimated reading time 8 minutes, 23 seconds.

They say that in good times an industry analyst is a cheerleader; in bad times, they’re a therapist.

These days, aviation industry analyst Richard Aboulafia finds himself in the position of delivering bad news, as he did on April 15 during a webinar organized for members of the Ontario Aerospace Council (OAC).

About 38 participants joined Aboulafia, who is vice-president of Analysis for the Teal Group Corporation, to discuss the civil aviation market outlook in the ongoing context of the COVID-19 pandemic.

“We’re looking at multiple shocks to the system,” Aboulafia told Skies the following day. “There’s the short term shock of factory closures and interrupted aircraft deliveries associated with the disease itself – that will be three to six months. Then, you’ve got the after-effects: recession for at least two quarters, the overcapacity hangover, and the massive drop in oil prices – which appears to be unrelated to COVID, it just sort of happened.”

While the word “unprecedented” is getting a lot of play these days, it’s certainly apt. The world – and the aviation industry – have never dealt with such a crippling economic blow.

“We’ve never seen more than 10 to 12 per cent of the world’s fleet parked and now we have almost 60 per cent parked,” said Aboulafia.

He added that air traffic numbers are not expected to fully recover until 2023 – and it’s all tied to the coronavirus. Basically, a complete industry recovery hinges on when a vaccine can be developed and deployed.

“I just have a hard time believing that people will be super excited to travel if the risk of a second or third wave of infections is still out there and we don’t have a vaccine,” explained Aboulafia. “One of my big takeaways is you can’t approach any of this without that epidemiological angle. The worst case scenario is that everything will wait until a vaccine is available, and experts say that could take 18 months.”

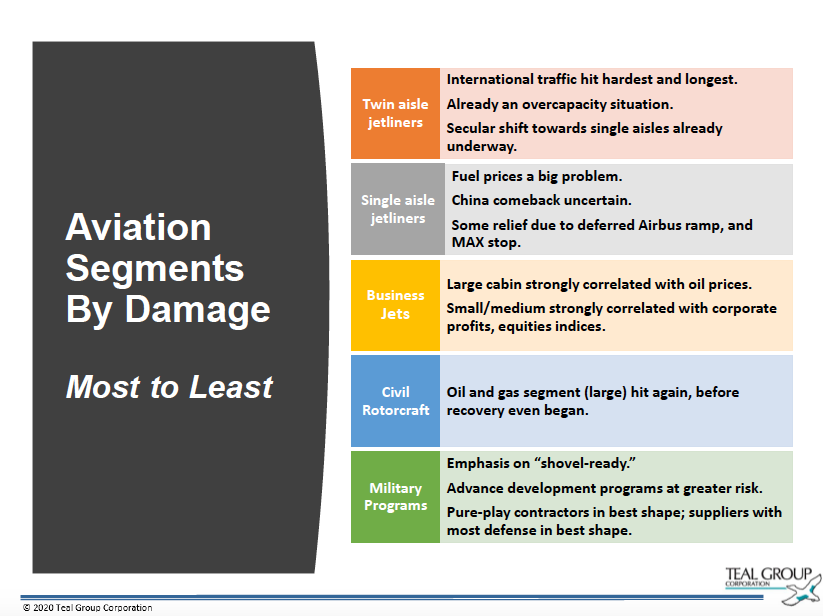

The analyst told OAC members that different market segments are feeling varied effects. Hardest hit are twin-aisle and single-aisle jetliners, followed by business jets and civil rotorcraft.

The one bright spot is the defence sector, which Aboulafia called a safe haven.

“Especially with U.S. defence spending, Congress tends to look at defence as a shovel-ready stimulus package. So, we’ll probably see an upside there [which will help Canadian companies that supply products to big U.S. defence programs].”

Commercial airliners are in the trough for the long haul, with the aftershocks of COVID-19 expected to play out for at least a couple of years.

“Jetliners have absolutely never seen numbers like these. Even in the worst years, whether it was 9/11 or Gulf War I or SARS, the year finished up and we were off by one or two or three per cent traffic year-over-year,” commented Aboulafia. “If we have a decent recovery in the fourth quarter, we’re going to have a 48 per cent drop this year – and that’s if we have a decent recovery, because right now we’re down 96 per cent.”

He is also concerned about business aviation, especially the higher-end large cabin aircraft. Traditionally, there has been a historical relationship between demand for those pinnacle platforms and oil prices.

In the civil rotorcraft segment, Aboulafia said small- and mid-sized helicopters will likely bounce back next year. However, there are too many larger models aimed at the weak oil and gas sector, which has never fully recovered from the decline in oil prices almost a decade ago.

“They were depressed already, so I’m hoping they have less of a distance to fall. The only thing I’m really concerned about is the one new program, the Bell 525 Relentless. Is that a casualty here? I think there’s a real chance of that.”

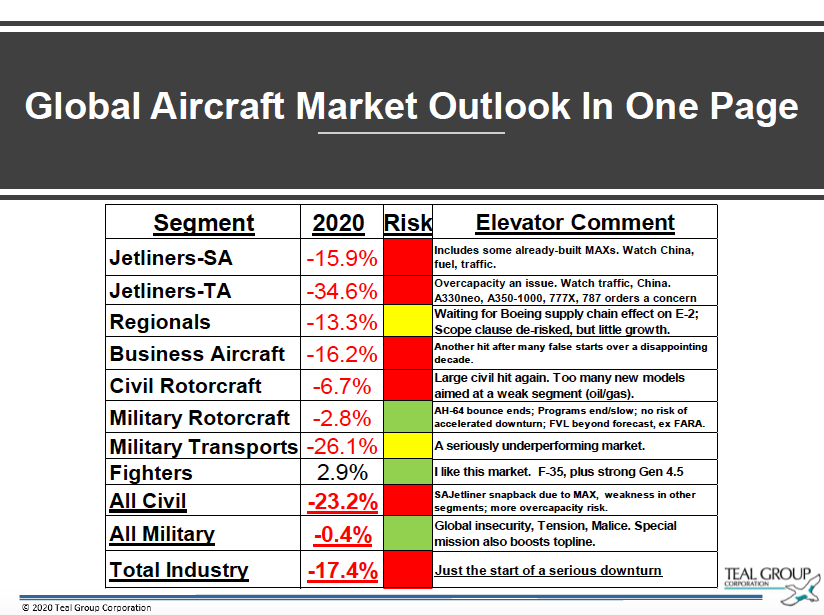

According to a chart prepared by Teal Group, the global aircraft market outlook overall will be down by an estimated 17.4 per cent in 2020 – and that is only the start of a serious downturn.

But Aboulafia said there are some bright spots, noting that airlines and business jet programs are in far better shape than during the last economic downturn.

“Airlines are better managed and if they get government aid, they stand a decent chance of pulling through. On the business jet side, there was so much over-inflation in order books and production plans and asset values back in 2008 – you could just feel it was going to be a disaster and that’s not the case this time. It’s generally become a more conservative market and that is good.”

Meanwhile, cargo operators continue to do a brisk business due to the absence of belly cargo availability, but Aboulafia called that surging demand a “short-term phenomenon.”

A synthetic market

Perhaps one of the most powerful descriptions of the new financial reality came from U.S. economist Paul Krugman, who referred to the economy of that country as being in a “medically induced coma.”

By extension, massive amounts of government aid must be pumped in to keep the global economy alive as the world waits for a vaccine that will conquer COVID-19.

Aboulafia termed the aid-generated demand a “synthetic market” that is necessary to prevent economic mayhem.

“In the absence of the organic market, the total requirements for new build aircraft this year and next are zero. Now, what combination of manufacturer, third party and government finance can change that? I am counting on some. The alternative is too grim to even contemplate. We can look at it from the standpoint of Airbus or Boeing.”

While he feels the recovery will take the form of a wide-bottomed U or L shape with a gradually angled floor, a return to peak operations will depend on vaccine development.

“There is a school of thought out there that says we will have a V-shaped recovery and that will keep production cuts from getting any worse – but I don’t subscribe to that for epidemiological reasons. I don’t see how you can get that V-shaped recovery unless everyone feels good about flying again. Plus, the pandemic hasn’t hit a lot of emerging markets yet, like India, Pakistan, Africa, Latin America. When it does, I fear something far worse that really triggers another wave.”

For the short term, aviation and aerospace companies can only hunker down, minimize the damage as much as possible and, most importantly, stick together.

Of his call with OAC members, Aboulafia said he was impressed with the regional solidarity in Ontario.

“There aren’t that many clusters that stick together like that, and it’s so important to think globally but act regionally. I was struck very happily by how much the aerospace ecosystem in Ontario is global, which is something I’ve been preaching for years.”