Estimated reading time 5 minutes, 59 seconds.

According to WINGX weekly Global Market Tracker

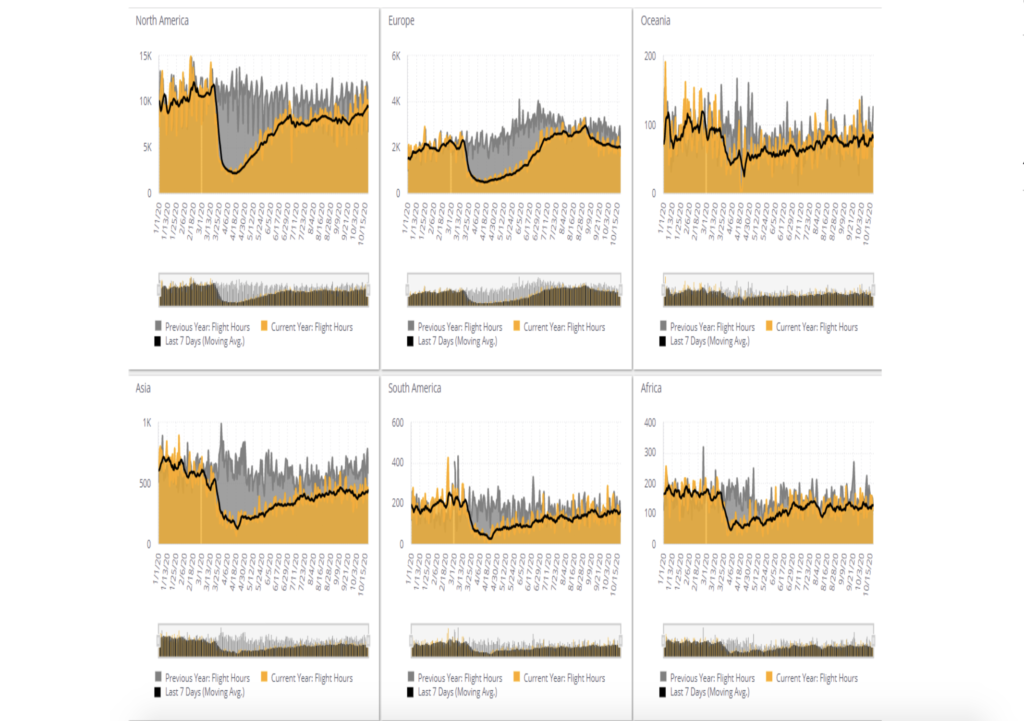

Global business aviation activity is down by 16 per cent in the first three weeks of October 2020 compared to same period in 2019. The trend remains far more resilient than for commercial airlines, which have seen a drop of 57 per cent in October YOY, a deficit of 933,000 sectors vs October 2019. Year to date, the respective bizav and airline trends are 24 per cent and 52 per cent deficits vs 2019. Regionally, Europe has stronger trends in business aviation than the U.S., but this month they are converging as Europe weakens and the U.S. modestly improves. Asia is relatively stable at 10 points below normal, whilst flights out of Latin America and Africa are trailing some 20 per cent below normal.

“Increasing efforts to suppress a winter virus wave are blunting flight recovery in Europe, with some notable country and airport exceptions. In the U.S., trends are improving modestly, and Florida continues to be the ballast, with charter demand pretty robust throughout the country,” said Richard Koe. “Outside the core markets, activity trends are 20 per cent below, with exceptions like China, but even there, flight hours are trending well below last year.”

“Increasing efforts to suppress a winter virus wave are blunting flight recovery in Europe, with some notable country and airport exceptions. In the U.S., trends are improving modestly, and Florida continues to be the ballast, with charter demand pretty robust throughout the country,” said Richard Koe. “Outside the core markets, activity trends are 20 per cent below, with exceptions like China, but even there, flight hours are trending well below last year.”

As virus concerns mount, European business jet activity has slipped back as October progresses. As predicted, leisure demand is dimming, and corporate travel is not yet coming back to the market. Rolling average trends in sectors flown have declined five per cent during the first three weeks of October. Flight hours are down by 17 per cent, and for sectors over three hours, activity is down by 33 per cent. For these longer sectors the decline has been most severe from Spain, United Kingdom and France, over 40 per cent in October 2020 compared to October 2019. There are some exceptions, with October YOY growth in long sectors flown to and from Turkey, Cyprus, Greece, Portugal.

Shorter sectors, less than three hours, are most robust, less than 10 per cent decline in the first three weeks of October. Some countries have seen an increase YOY in these sectors, notably Italy, Turkey, Austria, Russia, Sweden. Whereas from France and Spain, even short sectors are trailing by over 20 per cent, and from UK and Netherlands, more than 40 per cent drops. The UK is now the European back marker, flights trending down by 32 per cent in October YOY, and by 41 per cent for the period since March this year. So far in October, the London area has the biggest decline in bizav, with Luton activity down by 50 per cent, Farnborough by 37 per cent, Stansted by 33 per cent. Biggin Hill and Oxford are the outliers, both airports seeing growth in YOY activity this month.

North America, including Canada, Mexico, and the Caribbean, is maintaining trends over the last couple of months, flights down by 16 per cent. There is considerable divergence, with Mexico still 50 per cent below normal, similarly severe declines for Bermuda, Bahamas, and other parts of the Caribbean. The U.S., with an 88 per cent share of regional flight activity, has an October activity trend of -14 per cent, with a small but consistent improvement coming since September. Charter demand is buoying the market, with branded charter sectors down by only seven per cent, and charter hours up YOY vs October 2019. Fractional operations are also improving, activity down five per cent this month. The big decline is in private operations, which also includes corporate flight departments. This points to well-known weakness in business travel.

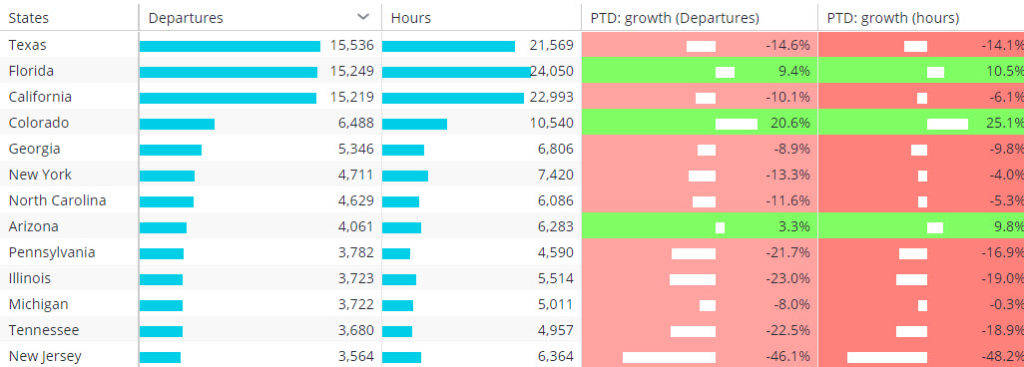

Regionally in the U.S., the varying pattern of activity favours a few States, with flights out of Florida up by nine per cent, Colorado getting 20 per cent more visitors this month versus last year. Arizona, South Carolina and Oregon are also seeing more bizav activity YOY. California is inching back to normality, with flight sectors down by 10 per cent, half the deficit we saw in September. The North East U.S. is also finally improving, with flights out of New York down by 13 per cent, flight hours down just 4 per cent. New Jersey remains a back marker, flights down more than 40 per cent.

Regionally in the U.S., the varying pattern of activity favours a few States, with flights out of Florida up by nine per cent, Colorado getting 20 per cent more visitors this month versus last year. Arizona, South Carolina and Oregon are also seeing more bizav activity YOY. California is inching back to normality, with flight sectors down by 10 per cent, half the deficit we saw in September. The North East U.S. is also finally improving, with flights out of New York down by 13 per cent, flight hours down just 4 per cent. New Jersey remains a back marker, flights down more than 40 per cent.

At an airport level, regional trends are reflected at Teterboro, still the busiest airport, but flights trending down 54 per cent, Dulles trailing by 37 per cent, McCarran likewise. This contrasts with strong growth in YOY business jet and prop departures from Florida’s leading airports Palm Springs, Miami-Opa Locka, Naples. Scottsdale and Salt Lake City continue their growth and this month Van Nuys is also up.

Outside Europe and North America, there continues to be a mixed picture, big declines in India, Saudi Arabia, gains for Qatar, Nigeria. China has an increase of 22 per cent in sectors flown this month, although flight hours are still down close to 20 per cent. Across all these countries, the best performing aircraft segments are turboprops and very light jets, activity 10 per cent off. Light Jet activity is down 18 per cent this October, with Midsize activity down 20 per cent. Super Midsize activity has slipped back this month, flights down 34 per cent, but heavy Jet activity is holding up at 26 per cent below. Ultra-long-range jets are flying 34 per cent fewer sectors this month, although flight hours are down by over 40 per cent.